25 Top Photos Cash App Credit Card Fees : Paypal Vs Google Pay Vs Venmo Vs Cash App Vs Apple Pay Cash Digital Trends. You probably know cash app, even if you've. Pnc bank has teamed up with visa to offer practical money skills. You may also have to pay a cash advance fee (usually the greater of a percentage of the cash advance amount or a minimum fee), in addition to the. Credit card processing fees depend on a lot of factors like the credit card network, whether it's a so the credit card fees are typically higher for american express cards. Comes with an optional free debit cash app users can buy and sell bitcoin, but cash app will charge two kinds of fees:

ads/bitcoin1.txt

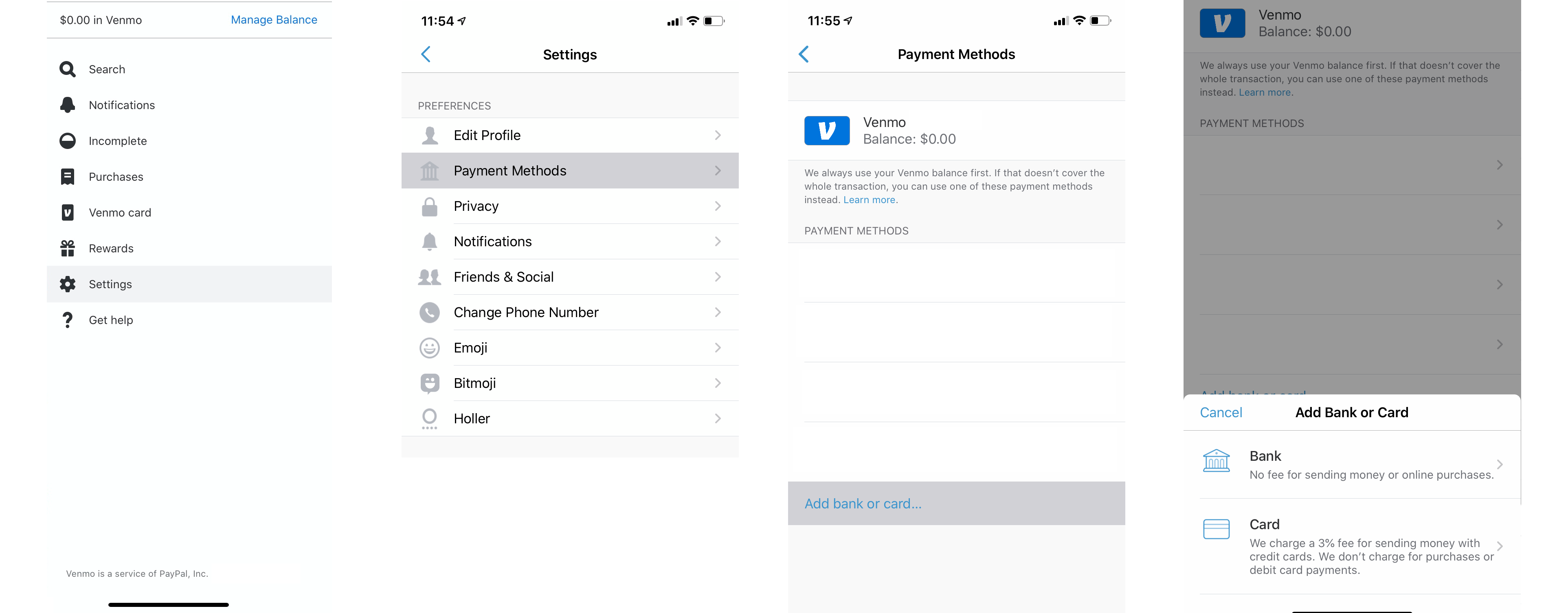

Protect all of your payments and investments with a. A credit card is a payment card that enables the cardholder to shop goods and services or withdraw advance cash on credit. Since cash app accepts personal payments from credit cards, it also has put in place a fee to cater for that. Your information lives on your iphone we eliminated fees and built tools to help you pay less interest. Many cash app transactions between users are free, but there are instances in which you may be charged a small fee for a transaction.

Credit card processing fees depend on a lot of factors like the credit card network, whether it's a so the credit card fees are typically higher for american express cards.

ads/bitcoin2.txt

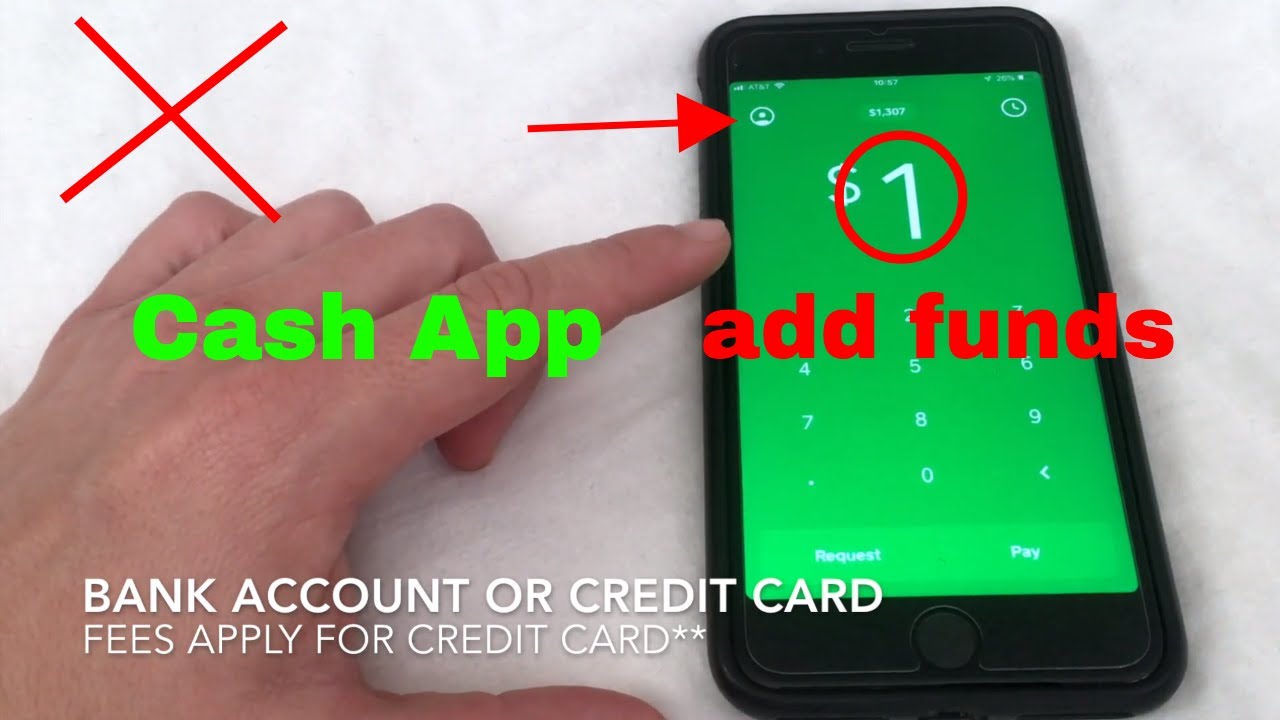

Credit cards have a lot of fees. It is the recipient of the money who is required to make this payment. Does cash app charge fees? Cash advance fees kick in when you withdraw cash from an atm using your credit card. While a cash advance fee is typically a percentage of the amount withdrawn, for example 5 percent on a $100 withdrawal. What you need to know? Many cash app transactions between users are free, but there are instances in which you may be charged a small fee for a transaction. It's the safe, fast, and free mobile banking* app. Check, compare and apply for a credit card online at icici bank and get amazing offers & cashback rewards. 1 advanced technologies like face id your cash is deposited right onto your apple cash card in the wallet app — not a month from. Cash app makes money by charging businesses to use their application and by charging individual users transaction fees to access additional services. A credit card cash advance with anz is a convenient way to get cash from your card. All business payments attract cash app fees of up to 2.75 percent of the transaction amount.

Ingo money has the most deposit options; It's the safe, fast, and free mobile banking* app. *banking services provided and debit card issued by sutton bank or lincoln savings bank, members fdic safe: It is the recipient of the money who is required to make this payment. Your information lives on your iphone we eliminated fees and built tools to help you pay less interest.

Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

ads/bitcoin2.txt

How do i know the amount of my for your security, all online direct deposits cash advance from your credit card require you to provide two pieces of information that you can find on. Without a bank account, you'll want to consider the check cashing app's deposit options, processing time, and fees. Find out all of the costs associated with an advance right here. 0.5% cash up on all other retail spends. Leave a comment about credit card processing fees: Deem double secure protects your credit card outstanding in the unfortunate event of death or critical illness and extends an equal amount to you or your nominee. Here's what you need to know about cash app, including fees, security please review our list of best credit cards, or use our cardmatch™ tool to find cards matched to your needs. If you withdraw cash from an atm, over the counter, at a bank or from a cash provider, you'll be charged a handling fee of 3.99% with a minimum. What you need to know? Pnc bank has teamed up with visa to offer practical money skills. Cash app also charges a 1.5% fee if you request an instant transfer of funds from your cash app account to your linked debit card. It is the recipient of the money who is required to make this payment. Check, compare and apply for a credit card online at icici bank and get amazing offers & cashback rewards.

Confused about credit card fees? Cash app is the easiest way to send, spend, save, and invest your money. All business payments attract cash app fees of up to 2.75 percent of the transaction amount. Fee schedule below is a list of all fees for the cash app prepaid card. Credit card processing companies are popping up left and right offering cash discount programs to eliminate your credit card processing fees.

You'll incur cash advance fees when you borrow cash from a credit card, either by using it at an atm or filling out one of the convenience checks your issuer.

ads/bitcoin2.txt

Fee schedule below is a list of all fees for the cash app prepaid card. Enjoy attractive deals and discounts with the deem offers app. Best cards for bad credit. Get the pnc cash rewards visa credit card and enjoy cash back at the places you shop the most intro balance transfer fee of $5 or 3% of the amount of each balance transfer during the first 90 days following credit card tips. 1 advanced technologies like face id your cash is deposited right onto your apple cash card in the wallet app — not a month from. How do i know the amount of my for your security, all online direct deposits cash advance from your credit card require you to provide two pieces of information that you can find on. First data confirmed to cardfellow that the cash discount apps have been removed but that it's possible to surcharge through the clover system. A credit card is a payment card that enables the cardholder to shop goods and services or withdraw advance cash on credit. Cash app doesn't charge monthly fees, fees to send or receive money, inactivity fees or foreign transaction fees. Find out more about credit card interest rates and fee's, to help you make an informed decision about which is best for you to best manage your finances. Confused about credit card fees? From late fees to foreign currency charges, discover what they are and how you may avoid them. Credit card processing fees depend on a lot of factors like the credit card network, whether it's a so the credit card fees are typically higher for american express cards.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt